The Trump administration’s recent tariff policy has stirred up the global economy and trade. It previously suspended tariffs on Mexico and Canada, but imposed a 10% tariff on Chinese imports in the early hours of Tuesday, triggering market fluctuations. Beijing quickly retaliated, exacerbating the risk of trade confrontation. At the same time, the EU is also highly concerned about the US tariff policy. Although the outlook is unclear, repeated tariffs will put pressure on the euro, and the EU hopes to engage with the US as soon as possible. In terms of economic data, US job vacancies in December hit the largest drop in 14 months, dragging down the US dollar and US Treasury yields, and boosting gold prices. Although the job market has not slowed down sharply, the Federal Reserve may not cut interest rates until at least June. The 10-year US Treasury yield has fallen, and its decline supports gold prices because it is the opportunity cost of holding gold. At present, investors are closely watching Wednesday's ADP, Friday's employment report and speeches by Fed officials. Under the dual influence of tariffs and data, the market trend is full of variables.

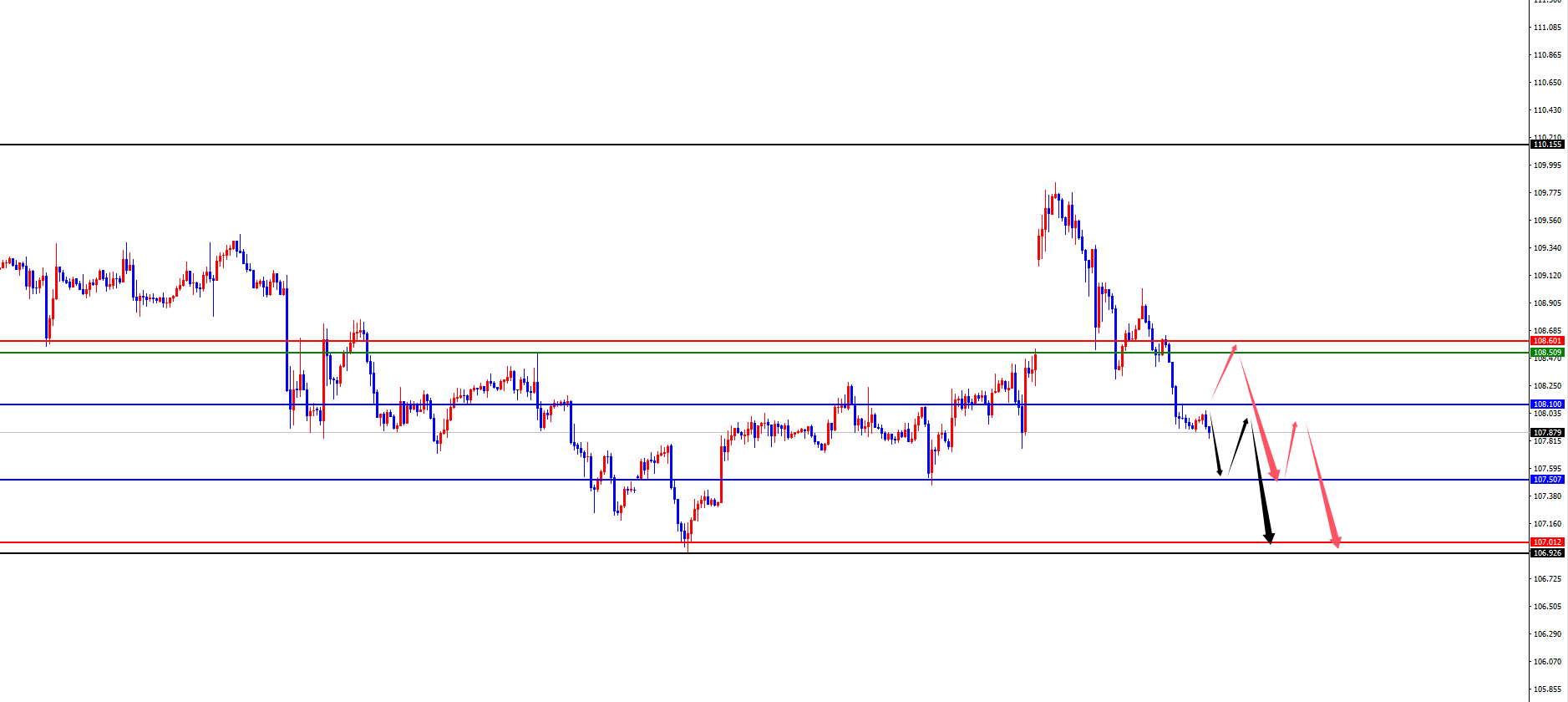

As for the US Dollar Index, the overall price of the US Dollar Index fell as expected on Tuesday. The price rose to 109.019 on the day, the lowest was 107.891, and closed at 107.975. Looking back at the performance of the US Dollar Index on Tuesday, the price was corrected upward in the short term as expected after the opening of the morning. From the position, the price just touched the area where it was arranged to be under pressure yesterday. Then the price was under pressure all the way, and the US market continued and ended with a big negative. At present, the US Dollar Index needs to pay attention to the gains and losses of the weekly support area of 107.50. After breaking this position, the US Dollar Index will be under pressure in the medium term. The short-term four-hour resistance is in the 108.50-60 range resistance, and the weekly support gains and losses can be paid attention to below.

US dollar index 108.50-60 range short, defense 5 US dollars, target 107.50-107

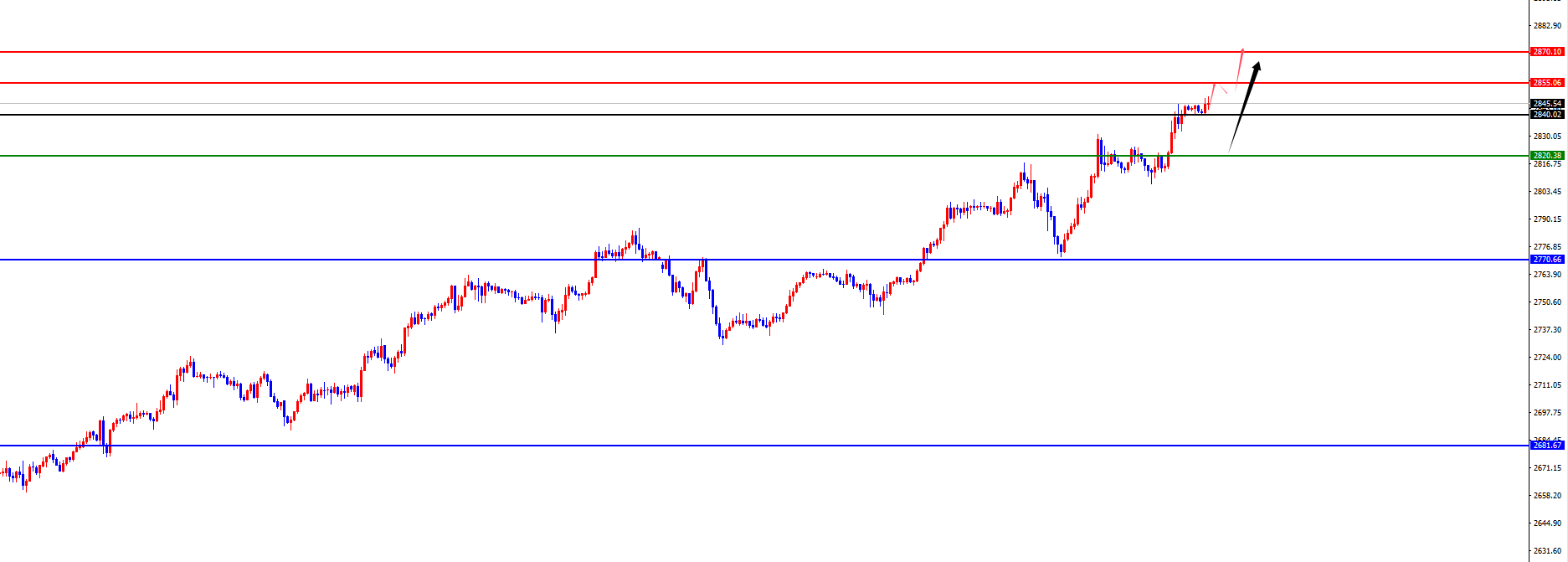

In terms of gold, the overall price of gold on Tuesday showed an upward trend. The highest price rose to 2845.24 on the day, and the lowest price fell to 2807.17, closing at 2841.77. Looking back at the details of the gold market performance on Tuesday, the price fluctuated during the early trading session, and then corrected downward again and stopped above the four-hour key support area before the European trading session. Since the overall market is bullish, it rose directly after the European trading session, and the US trading session also accelerated again to set a new high. The current daily support is at 2770, and the price above this can be treated as a long-term trend. In the short-term four-hour, temporarily pay attention to the support of the 2720-2721 range. Above this position, it can still be treated as a long-term trend. At the same time, if the one-hour Asian session directly breaks through the high point of the previous day, the subsequent short-term focus will be on the gains and losses of today's early trading lows. If the early trading lows are not broken, it is expected to continue to rise, but if it breaks down, it must wait for the four-hour support area to see further increases. The upper side is currently focusing on the 2855-2870 area.

Gold 2820-21 range, defense 10 US dollars, target 2855-2870 (short-term early lows determine whether it can be supported again in four hours)

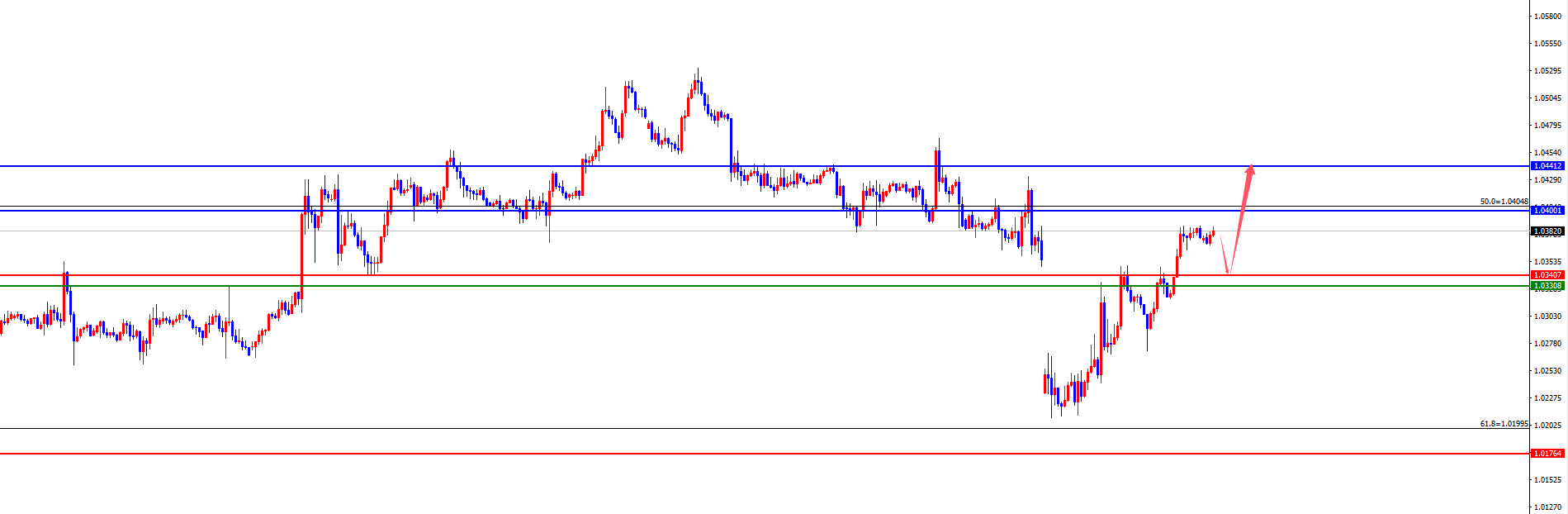

In terms of Europe and the United States, the overall price of Europe and the United States on Tuesday showed an upward trend. The price fell to 1.0270 at the lowest point of the day, rose to 1.0380 at the highest point, and closed at 1.0378. Looking back at the performance of the European and American markets on Tuesday, after the opening of the morning session, the European and American prices first corrected downward in the short term, and then the price tested the 1.0270-80 range and stopped rising as the author Yan Ruixiang said. Then, after the European session, it tested the high point of the morning session again, and then it hit the intraday high position again in the US session. The market as a whole is running according to the analysis. At present, it is necessary to pay attention to the breakthrough performance of the daily resistance of 1.0400 and the weekly resistance of 1.0440. Once the price breaks up, it is expected that the bulls will make a big move again (band and mid-term). In the short-term four-hour, temporarily pay attention to the support of the 1.0330-40 range, and focus on the breakthrough performance in the future.

Europe and the United States are more in the 1.0330-40 range, defending 40 points, and the target is 1.0400-1.0440

① 08:30 Federal Reserve Vice Chairman Jefferson delivered a speech

② 09:45 China's Caixin Services PMI in January

③ 15:45 France's December industrial output monthly rate

④ 16:50 France's January Services PMI final value

⑤ 16:55 Germany's January Services PMI final value

⑥ 17:00 Eurozone's January Services PMI final value

⑦ 17:30 UK's January Services PMI final value

⑧ 18:00 Eurozone's December PPI monthly rate

⑨ 20:30 Fed's Barkin accepts media interviews

⑩ 21:15 US ADP employment in January

21:30 US December trade account

21:30 US Treasury announces quarterly refinancing plan

22:00 Fed Barkin attends a fireside chat

22:45 US January S&P Global Services PMI final value

23:00 US January ISM non-manufacturing PMI

23:30 US EIA crude oil inventory for the week ending January 31

23:30 US EIA Cushing crude oil inventory for the week ending January 31

23:30 US EIA strategic oil reserve inventory for the week ending January 31

02:00 the next day Fed Goolsbee delivers a speech

04:00 the next day Fed Governor Bowman delivers a speech