On December 19, Beijing time, Thursday, in the early Asian session, the US dollar index hovered around 108.10. On Wednesday, the Federal Reserve unexpectedly cut its expectations for interest rate cuts next year by half, and the US dollar index violently rose 120 points, eventually closing up 1.228% at 108.26, a new high since November 2022. U.S. Treasury yields rose collectively, with the two-year Treasury yield closing at 4.363% and the 10-year Treasury yield closing at 4.519%, both rising more than 10 basis points during the day. Spot gold plunged during the session, falling more than $50 after the announcement of the Fed's decision, falling below the $2,590 mark, and finally closing down 2.3% at $2,585.78 per ounce, a one-month low. Spot silver then plummeted, eventually closing down 3.85% at $29.36 per ounce, a three-month low. Although the decline in U.S. crude oil inventories shows the resilience of demand, the Fed's hint of a slowdown in the pace of interest rate cuts has dampened optimism, and both oils have fallen for the third consecutive trading day. WTI crude oil finally closed down 0.62% at $69.36 per barrel; Brent crude oil closed down 0.63% at $72.59 per barrel.

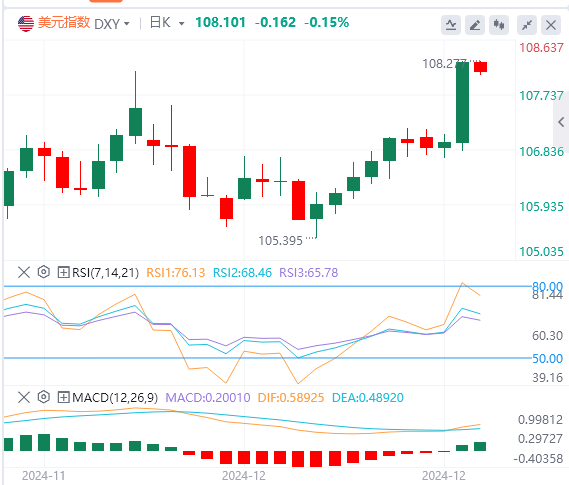

US dollar index: As of press time, the US dollar index hovered around 108.10. The Federal Open Market Committee (FOMC) lowered the federal funds rate to a range of 4.25-4.5% on Wednesday with 11 votes in favor and 1 vote against. Cleveland Fed President Beth Hammack voted against it, and she prefers to keep the interest rate unchanged. Technically, the US dollar index continues to try to close above the resistance level of 107.10–107.30. If the US dollar index successfully closes above the 107.30 level, it will move to the next resistance level of 108.30–108.50.

Euro: As of press time, EUR/USD hovered around 1.0374. EUR/USD fell last Wednesday, closing at 1.0353, a drop of 1.32%. EUR/USD fell sharply after the Fed cut interest rates but took a slightly hawkish stance as the central bank expects 100 basis points of easing over the next two years. Technically, the RSI is still in mild territory, so there is enough room for additional downside momentum if the right catalyst appears.

GBP: As of press time, GBP/USD is hovering around 1.2585. GBP/USD fell on Wednesday, closing at 1.2573, down 1.08%. GBP/USD then held above 1.2700 before falling after the US Federal Reserve (Fed) announced a 25 basis point cut in the policy rate (federal funds rate) to a range of 4.25%-4.5%. Technically, if GBP/USD climbs above the resistance level of 1.2700–1.2715, it will move towards the next resistance level of 1.2850–1.2870.

In the Asian session on Wednesday, gold traded around 2597.46. Gold prices plunged as Federal Reserve Chairman Jerome Powell took a stance following the U.S. central bank's decision to cut interest rates. Forecasts indicate a less dovish stance from the Fed. Fed Chairman Jerome Powell said the central bank is likely to take a more cautious approach to future policy adjustments, noting that current measures are less restrictive. He stressed that inflation risks and uncertainties remain tilted to the upside, which partly explains the change in the dot plot.

Technicals: Gold prices remain biased to the upside, although they have been trading sideways for the past three days with no clear direction. Gold is trading in the $2,602 to $2,670 area, capped by the 100-day and 50-day simple moving averages (SMAs), respectively. To resume bullishness, gold must clear $2,650 and then the 50-day SMA at $2,670. If exceeded, the next stop would be $2,700. Conversely, if gold falls below the 100-day SMA, the next support would be $2,600. If prices slide, the next support level will be the swing low of $2,536 on November 14, and then challenge the high of $2,531 on August 20.

Crude oil traded around 69.52 in the Asian session on Wednesday. Oil prices closed higher as U.S. crude oil inventories fell and the Federal Reserve cut interest rates as expected, but the gains were limited as the Fed said it would slow the pace of rate cuts. The U.S. Energy Information Administration (EIA) said on Wednesday that U.S. crude oil inventories and distillate inventories fell in the week ending December 13, while gasoline inventories rose.

Technical: If WTI crude oil closes above $71.00, it will move towards the nearest resistance level of $72.00-$72.50.

Foreign exchange market trading reminder on December 19, 2024

11:00 Bank of Japan announces interest rate decision

14:30 Bank of Japan Governor Kazuo Ueda holds a press conference

15:00 German Gfk consumer confidence index for January

15:00 Swiss trade account for November

17:00 Eurozone seasonally adjusted current account for October

20:00 Bank of England announces interest rate decision and meeting minutes

21:30 U.S. initial jobless claims for the week ending December 14

21:30 U.S. third quarter actual Final value of annualized quarterly rate of international GDP

21:30 Final value of quarterly rate of real personal consumption expenditure in the third quarter of the United States

21:30 Final value of annualized quarterly rate of core PCE price index in the third quarter of the United States

21:30 Philadelphia Fed manufacturing index in December of the United States

23:00 Annualized total number of existing home sales in November of the United States

23:00 Monthly rate of leading indicators of the Conference Board in November of the United States

23:30 EIA natural gas inventory in the United States for the week ending December 13

03:30 the next day, the last transaction of New York crude oil January futures was completed